👋 Hey expats, this is Dexter. Welcome to a new edition of Money Abroad, my weekly newsletter where I bring you fresh tips on building wealth while living abroad.

Today in 10 minutes or less, you’ll learn:

🧰 Popular personal finance tools for expats

😯 Surprising use cases

🔥 Quick tips & hacks

Let’s go!

🧰 Expat Personal Finance Toolkit

🗺 Top Expat Hubs

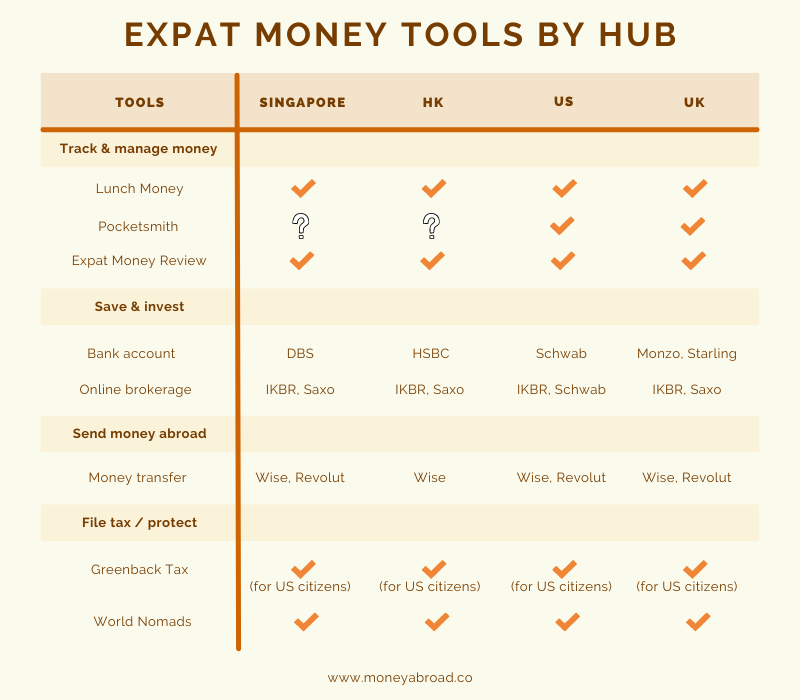

We are going to cover tools for the top subscriber regions:

Singapore

Hong Kong

United States

United Kingdom

🤩 Criteria

Low or minimal fees

Fast, easy-to-use UX

Accessible for foreigners (and Americans)

Responsive customer service

Secure

🧮 Track and manage money

Lunch Money (paid: $10 USD / month)

Lunch Money is a simple personal finance tool with bank integrations across 17 countries, crypto wallet integrations, budgeting, and trend visualizations.

Who is it for: Expats that want an easy-to-use budgeting tool that works across currencies and importing crypto & supported bank accounts

Surprising use case: “It was super easy to label all the expenses related to our wedding to figure out at the end exactly how much it cost / the breakdown of different categories for it” - Canadian expat

Tip: Try the Rules Engine to auto or manually create rules to automatically categorize your transactions and trigger notifications.

Pocketsmith (paid: $9.95 USD / month and up)

Pocketsmith is a more comprehensive personal finance tool with auto bank integrations across 49 countries (rarity!), budgeting, and cashflow management features.

Who is it for: Expats that want max coverage with automatic bank imports and more sophisticated analysis features

Surprising use case: “I use it as a searchable archive since bank statements go into the ether after 90 days.” - German expat in US

Tip: Tap into the cashflow reporting tool to project out your future budgets.

Caveats:

Janky bank connections. Multiple Singapore & HK banks are labeled ‘Experimental’. I personally tried linking my DBS Singapore account, hit an error, and couldn’t proceed further.

Outdated design. ”UI and mobile are kinda old”

Expat Money Review (free)

Expat Money Review is a simple Google Sheet template for tracking net worth, income, and expenses across currencies as an expat couple or individual. (My fiance and I currently use this tracker.)

Who is it for: Expat couples or individuals that want a free solution to consolidating their assets and liabilities across multiple currencies

Surprising use case: I track unpaid taxes using the net worth tracker, so we keep enough cash buffer to avoid nasty surprises during tax season.

Tips & hacks: Calculate your “guilt-free spend” using the Income & Expenses tab. Then setup automated transfers so the remaining balance in your bank account is always yours to spend on whatever you want.

🌱 Save & invest

Foreigner-friendly local bank account (DBS in Singapore, HSBC in HK, Monzo in UK, Schwab in US)

Banks with expat features like ATM fee refunds, no foreign exchange fees (normally ~3%), and multi-currency accounts. (I use DBS.)

Why local: Sadly, no global bank (that I’m aware of) is consistently great in availability, UX, customer service, and security ie deposit insurance across all 4 expat hubs. Please DM me and prove me wrong!

Alternative: For temporary needs, go to the Wise section to learn more about how to quickly create local bank account details.

Interactive Brokers (also Saxo in SG/HK/UK, Schwab in US)

IB is an online trading services with access to global markets, multi-currency support, low fees, and breadth of financial products. (I don’t actively use IB since I maintain my US investment accounts.)

Who is it for: Expats who plan to invest from multiple countries, but want to consolidate to a single brokerage account

Surprising use cases:

Get low FX rates. FX fees at 0.002% with a $2 USD minimum. “I now just use [IB] to transfer GBP to USD” - American expat in UK

Moving countries. Most brokers are tied to a local country. For IB, you can keep your account open when you move.

Tips & hacks:

Prepare to swap currency. “You might have to convert the currency within the platform to USD if you're buying US equities and you topped up in SGD.” - Romanian expat in Singapore

Americans should use US brokerage to trade US funds. “In my opinion, Interactive Brokers is the best, but only if you can open a US account. Since I opened a UK account (unknowingly) it only allowed me to trade UK funds which are more expensive, so I stuck to Fidelity US.” - American expat in UK

🌎 Send money abroad

Wise is an online money transfer app with low-fees and 50+ currencies. Revolut also offers free transfers under certain conditions, but has more limited coverage. (I use both Wise & Revolut for money transfers)

Who is it for: Individuals or small business owners that wants to send or receive money from a person or business in another country.

Surprising use case:

Get local bank account details from anywhere. “A lesser known feature is that Wise is also a global account. You can issue yourself local account details globally, so that you can receive like a local in multiple currencies.” - Vinay Palathinkal, Regional Head @ Wise Platform

Automating your transfers. Setup recurring transfers to automate your expat money system across 2+ countries.

Tips & hacks:

Investing in foreign assets. “A great hack is using Wise to fund investments in foreign-domiciled assets. I love Robinhood - been a (not-so-successful) trader on the platform since 2016. After I returned to Singapore, I remained a fan, and Wise has helped me with my funding experience. Wise has a Plaid integration that directly links deposits from my Wise balance, so you can fund directly from your Wise balance to Robhinhood, which is cool.” - Vinay

Setup rate alerts for cheaper rates. Wise can automatically send you an email alert when the exchange rate drops below your preferred threshold.

(Caveat: Wise is not a bank itself and works with bank partners, so your funds are not regulated under bank deposit insurance schemes.)

📅 File taxes

Greenback is a one-stop shop online tax service for American expats. 4.8 Trustpilot rating. (I used Greenback for my 2020 & 2021 US tax returns and had a positive experience.)

Who is it for: Americans living overseas with standard tax filing needs

Surprising use case: Reporting your foreign assets across an alphabet soup of required compliance forms (FBAR, FATCA, PFIC…) & avoiding huge fines!

Tips & hacks: Send your tax accountant your questions regarding upcoming tax events like a stock secondary sale so they can help to strategize on how to optimize taxable income.

🛡 Protect yourself

World Nomads is a travel insurance that covers people from 130+ countries, medical and evacuation activities, and adventure activities. (I used World Nomads in 2019 and had a good experience.)

Who is it for: Expats who are frequently traveling for work and play or without emergency coverage outside of their host country

Surprising use case: Many travel insurance policies DO NOT cover adventure sports like scuba diving, free diving, or outdoor rock climbing. World Nomad covers these and more.

Tip: Call their 24-hour emergency assistance hotline if you’re feeling ill while traveling.

Heard any juicy expat money tips recently? Reply or DM me links.

What'd you think of today's email?

Money Abroad content is for informational purposes only. Although I share my personal research and experiences, you shouldn’t construe anything here as legal, tax, investment, financial, or other advice.