In partnership with

Hey {{first_name | readers }},

The market rollercoaster ride continues. 🎢

In good news, I’m excited about our EPIC line-up of upcoming Community Spotlights. Ex-bank COO, national record holder in powerlifting, AI consultancy founder, product managers, content writers, and more.

We’re booked 2 months out. If you’d like to share your story, reply soon!

Today, in 5 minutes or less, you’ll learn:

💰 5 moves I'm making with my money right now

📊 Asset allocation I'm maintaining through the volatility

🎢 The expensive mistake I made in 2020 (and won't repeat)

SPONSORED

📊 Build a Financial Plan That Doesn’t Suck

When I started our household financial plan, it was painful.

Just imagine - cobbling together spreadsheets, tax data, and complex calculations. It was a mess.

That’s why I’m excited about recently discovering ProjectionLab.

ProjectionLab is a modern financial planning tool for people who want to explore early retirement, build long-term wealth, and make smart money decisions.

It combines beautifully designed visuals with real-time simulations to make financial planning intuitive, powerful, and even fun!

With ProjectionLab, you can:

📈 Visualize your net worth, income, and expenses

🏡 Map life events like career changes, kids, a new home, or a move abroad

🌤️ Stress-test major decisions with clarity and confidence

🛠️ Build flexible plans that grow and evolve with you

Ready to optimize your plan for uncertain markets?

Try out ProjectionLab for FREE:

To get your brand in front of 7k+ professionals and entrepreneurs, fill this out and let's chat.

💎 Last Week’s Gems

🏖 If you’re close to retirement, then last week was tough. But the data reveals surprising insights. Here’s what happened if you withdrew 4% on the eve of the crash of 1929.

🛍 Shopify CEO published an internal memo saying they’ve made it a requirement that ANY new hire must be justified by proving AI can’t do the job better. Aka brace yourselves.

💼 Elena Verna, ex-VP Growth at Dropbox and Surveymonkey published a viral piece on why she thinks the future of full-time employment is changing:

“I realized the ultimate career flex isn’t building someone else’s dream, chasing a title, or flying first class to company off-sites. It’s having career optionality - being in a position where full-time roles are just one of many ways you can engage with the market, not the only way and definitely not a requirement.”

⚔️ Surviving today's volatile markets

The S&P 500 dropped 10.5% in just 2 days.

That was the fifth worst 2-day period for the stock market since 1950.

I'd be lying if I said it didn't feel painful looking at the red in my accounts.

What am I doing in response?

In this edition, I’m going to walk through exactly what I’m doing right now financially as a Coast FIRE solopreneur and why.

Let’s get into it:

What I’m doing right now

My wife is employed full-time and I’m a solopreneur. No kids.

For the most part, we’re sticking to our financial plan:

Increasing from 9-month to 12-month emergency fund

Keeping investments in the market

Maintaining asset allocation according to our plan

Investing monthly towards retirement

Contributing to a 529 (college), K-12, and family fund

Rebalancing where it makes sense

Not predicting the future. Not making rash decisions.

Whether markets rise or fall, our household is still progressing towards our life goals.

This doesn’t mean I don’t think the world is changing. Or that our plan shouldn’t adapt to a potentially more uncertain future.

Our financial plan should be pressure-tested against reality, tailored to our lives, and updated periodically.

Just not as a knee-jerk reaction to the market drop.

I learned this the hard way in March 2020.

My expensive mistake during COVD

I sold a portion of my US stocks while COVID battered the market.

Then once the market recovered, I got back into the market too late, missing out on thousands of dollars of gains.

I know, I know. Classic market timing mistake. I reacted emotionally.

Since then, I’ve put more time and energy into making a good plan.

It’s been worth it.

Here are the building blocks I laid out earlier:

1/ Increase to a 12-month emergency fund

Last year, we had a 6-month emergency fund, but I no longer think it’s enough given potentially more uncertainty.

Our income is healthy right now, but I want to be prepared in case shit hits the fan.

Furthermore, I expect continued challenges in the tech hiring market.

Product Manager job openings are still down ~90% since March 2023. I foresee companies following Shopify CEO’s lead in asking for new hiring to be justified to be better than AI.

Source: Aakash Gupta

In a worst-case scenario, I have no issue with going back to a full-time role (as part of my portfolio career). But I also don’t want to take a role I’d regret due to limited runway.

A 12-month reserve helps us build have more flexibility.

2/ Maintain a globally diversified asset allocation

Our portfolio has been a mix of US and non-US investments for years.

But the recent events confirmed why we prefer international diversification.

While US equities have outperformed over the last decade, I can’t predict what will happen in the next decade (or the 30 years prior to “retirement age”).

Here is our rough household portfolio mix:

~15% cash (maintain)

~60% public equities (target: 65%)

~20% real estate (target: 15%)

~5% crypto/angel (maintain)

Our current equity allocation:

~70% US (target: 64% US)

~30% non-US (target: (36% non-US)

Our target equity mix mirrors VT, which tracks the FTSE Global All Cap Index:

Currency is another component.

While most of our funds are USD-denominated now, we’re also considering increasing our non-USD cash/equity over time.

(We live outside the US and spend non-USD in our day-to-day lives.)

3/ Rebalancing where it makes sense

Further market declines might open up rebalancing opportunities.

For example, in my taxable brokerage I own:

VOO (US S&P 500)

VXF (US ex-S&P 500)

VXUS (non-US)

I wanted to consolidate to VTI + VXUS or even VT, but I couldn’t sell off my ETFs without getting hit with a sizable capital gains tax.

More blood on the streets may allow me to make this move without the extra taxes.

4/ Continue contributing to our family sinking funds

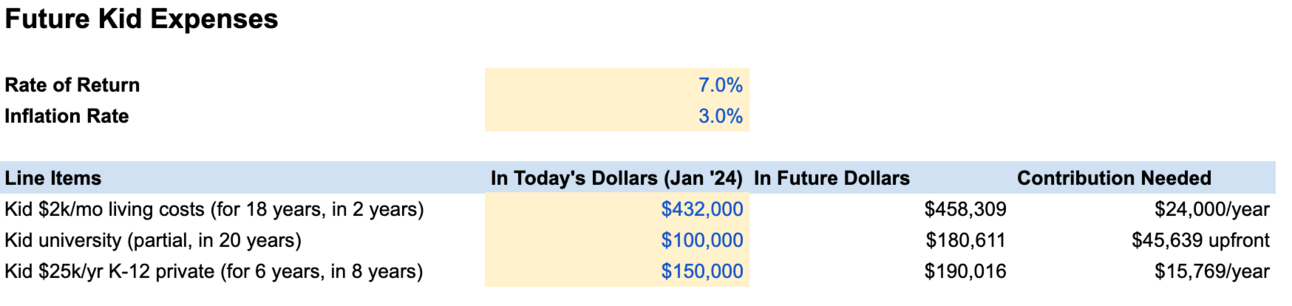

Last year, we created a plan to build sinking funds for future kid-related expenses:

529 / University Education Fund

K-12 Private Education Fund

Childbirth and Living Expenses

Despite the market turmoil, nothing’s changed on this front.

We are still pursing our life goals.

With a bit of discipline, we are on track to fully funding our 529 and childbirth/first year funds by EOY.

5/ Build AI skills, reputation, and distribution

This isn’t part of my financial plan per say, but still important.

I suspect the layoffs we’re seeing is just the beginning. More established companies may struggle to adapt to the brutal market landscape, leading to further restructuring.

So if full-time employment is no longer stable, then what?

It becomes crucial to learn how to build a business around your skills, reputation, and distribution.

Even if an employer takes your job away, they can’t take away what you’ve built for yourself.

This is at the heart of building leverage and optionality for yourself.

So there you have it. Those are a few of the building blocks in my plan.

In summary

Ben Carlson, Director of Institutional Asset Management at Ritholtz Wealth Management, recently wrote:

“Every investor needs their own survival plan. The most important thing is having a plan in the first place.”

I completely agree.

The one thing I will add:

It’s important to design a plan that fits you.

While I shared our plan, yours may look very different depending on your stage of life and unique household situation.

And if you don’t have one yet:

There’s no better time than now to start building your financial plan.

✨From Our Community

📩 Want to be featured in our Community Spotlight? Reply to this email and let’s chat!

We have a badass line-up - ex-bank COO, national record holder in powerlifting, AI consultancy founder, product managers, and more. I’ll start dripping their stories in this section soon!

Whenever you’re ready, here’s 3 ways I can help you:

1. Part-Time Consulting Launchpad - Join 800+ professionals on the waitlist for my 8-week cohort program to launch a profitable consulting side hustle.

2. Linkedin Growth Coaching - Accelerate your growth on Linkedin and generate inbound opportunities.

3. Promote yourself to 7,000+ high-performers by sponsoring my newsletter at a 55%+ open rate.