Hi {{ first_name | there }},

Today’s edition is about the tango between two of my favorite subjects - personal finance and a portfolio path.

Let’s dive in!

Today, in 10 minutes or less, you’ll learn:

🧠 Financial independence vs financial flexibility

💰 Why Coast FIRE helped unlock my portfolio career

❓ Three questions to separate money anxiety from actual financial constraints

SPONSORED

🤩 Apply to Portfolio Path Membership

Tired of navigating your portfolio career alone?

If you have 5+ years of working experience and are building a portfolio career, apply to join our invite-only Portfolio Path Membership - launching August/September 2025.

🚀 Why join the community: Accelerate your learning, grow your revenue, and build genuine relationships with like-minded peers on the portfolio path—so you can go further together than solo.

🎯 What you get: Monthly community calls, expert fireside chats, 30-day challenge, accountability buddies, and shared resource library.

⏰ Why now: Early members lock in founding member perks and the best lifetime rate.

We can't wait to meet you!

Limited founding spots available. Apply now, and we'll contact you with more information soon.

To get your brand in front of 7k+ professionals, founders, and consultants, fill this out and let's chat.

🔓 How to financially unlock your portfolio path

In 2023, I left my last full-time tech job.

This means I’ve been working independently for the last 2 years. (time flies!)

But before pulling the trigger, I assessed factors like my personal finance goal:

Did I feel financially secure enough to take a risk?

If you’re like me and the hundreds of professionals I’ve spoken with, you want to avoid getting yourself into a tough spot financially:

Here’s the conventional wisdom online:

Save aggressively until you hit financial independence. Then you are free to do whatever the hell you want. (In my 20’s, I bought into this.)

But I realized something recently:

Financial flexibility is very different from financially independent. I wasn’t FI, but that didn’t mean I wasn’t secure.

In this edition, I define financial flexibility vs financial independence, why I chose Coast FIRE, and 3 questions to ask yourself to financially unlock a portfolio path.

💰 Financial flexibility vs financial independence

Nick Maggiulli, personal finance blogger and COO of Ritholtz Wealth Management, recently wrote about the differences:

Financial Independence (FI) is when you reach a level where the income generated from your investments and assets can pay for your lifestyle expenses without your needing to work.

Financial Flexibility is about having options with your money. You don’t need FI to have financial flexibility.

For a long time, I chased financial independence.

But in my early 30’s, I began to question if it was the right goal for me - and asked myself why.

After reflecting, I realized that growing up in a financially unstable household led me to latch onto the idea of FI. It felt safe. Comfortable. Freeing.

Most FI people I meet don’t use flamethrowers. (Credit: NYT)

But I also felt skeptical:

On one hand, I've met professionals who hit FI, allowing them and their families to live their rich life. When executed well, it’s awesome.

On the other hand, I've watched others obsess over their FI number - to the point of sacrificing relationships, health and fun.

That’s when I started to separate the notion of financial security from 100% financial independence.

Enter Coast FIRE.

🌊 Why Coast FIRE unlocks options

I forget where I heard about Coast FIRE, but it shifted my perspective.

Coast FIRE means having enough invested that your current portfolio will grow to cover your future retirement - without adding another penny.

Unlike traditional FI, you don’t need to focus on aggressively saving until you achieve retirement.

Instead, you just need to cover your life expenses through work you enjoy.

Credit: Money

To be clear, you don’t get to stop working like FI.

However, you get more flexibility to switch to lower-paying but more meaningful work, start a business, or even pursue a portfolio career.

This resonated with me deeply.

I love working. It brings me a sense of purpose and I can’t imagine stopping for the sake of retirement.

But at the same time, I wanted greater career and life flexibility.

📊 How the math works

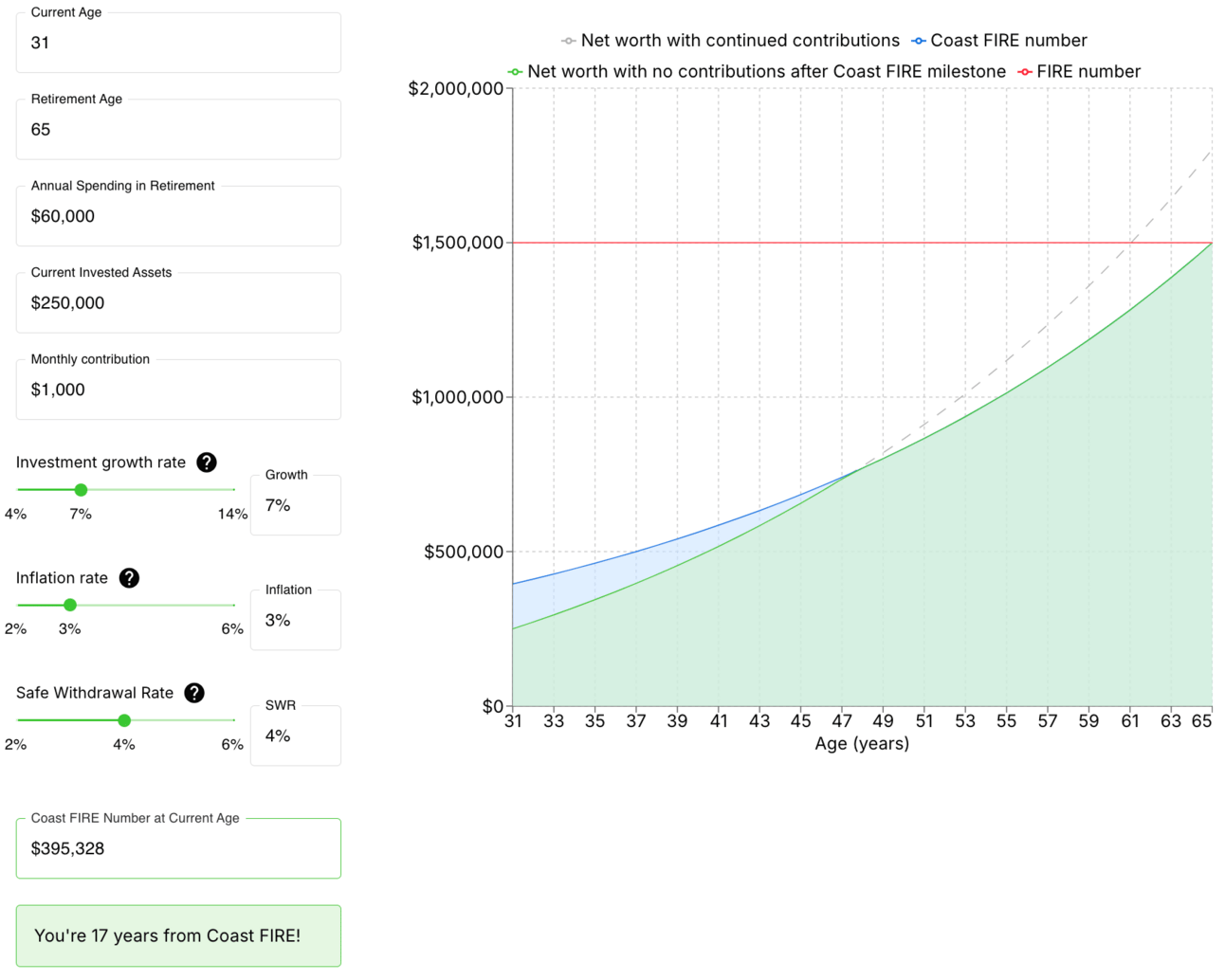

I used this online calculator to calculate my Coast FIRE number.

You need to input assumptions like age, annual spending, monthly contributions, growth rate, and inflation rate.

What I used:

7% investment growth rate

3% inflation rate

Here's an example of what a 31-year-old expecting to work until their mid-60’s would need to invest to hit CoastFIRE:

🧠 The psychological shift I made

Something clicked when I ran my Coast FIRE numbers.

It sounds silly, but I felt the pressure I put on myself vanish.

For the first time, I could separate my current income needs from my long-term retirement.

I obviously still needed to cover rent, food, and daily life expenses. But I didn’t need to optimize for maximum wealth accumulation.

This realization helped me give myself permission to run experiments. To make career decisions irrespective of money.

That’s when I launched the expat money newsletter and took on a couple of startup advising gigs.

None of these moves would have made sense if I was chasing FI.

🚧 The real barrier is not money

Now, I realize that the biggest obstacle to pursuing a portfolio path isn't money. It's the story we tell ourselves about money. (Plus, identity.)

Many professionals think they need complete financial independence before they can explore alternative career paths.

But that's a perfectionist myth.

The truth is simpler:

You need enough financial security to responsibly experiment without risking your daily lifestyle needs.

But beyond that, you have quite a bit of flexibility.

📝 Three questions to ask yourself

And if you're still feeling stuck, consider these other questions:

First, what's really driving your fear of pursuing something unconventional? Is it actual financial constraints, or anxiety about what might happen?

Second, does financial security need to mean complete financial independence for you? Or could it mean having enough flexibility to take thoughtful risks?

Third, if you reframed your goals around financial flexibility rather than financial independence, what would become possible?

These questions helped me change my relationship with fear - especially around money.

Hopefully they help you too.

🛤️ The path forward

Reframing financial independence as financial flexibility opened new doors for me.

Here’s what we covered:

Financial independence vs financial flexibility

Why Coast FIRE unlocked options

How to calculate your Coast FIRE number

The psychological shift I made

The real barrier isn’t money

Three questions to ask yourself

But ultimately, this is just my story.

I look forward to hearing about ways you find to financially unlock your portfolio path.

What’d you think of this piece? Reply and let me know your thoughts - I read every email.

💎 Last Week’s Gems

✈ The Death of the Amex Lounge: Why the Upper Middle Class Isn’t Special Anymore (ODAD)

🧑💼 Are middle managers reconsidering what a fulfilling career looks like? (LinkedIn)

🧰 Curious Beginner’s Guide to AI Agents (Peter Yang)

🤩 Community Spotlight

If you've been considering joining the Portfolio Path Membership, now is the time. We have so many great speakers coming in to share their knowledge.

This week? Makar Stetsenko, Fractional CTO & cohort alum, is showcasing exactly how he landed his second fractional CTO client in just a few weeks.

Apply to Portfolio Path membership and come join events like this LIVE. We’ll be addressing Q&A from specific members on this call.

Dexter Zhuang

Say hi 👋 on LinkedIn or Substack Notes

🚀 Partner with Portfolio Path

Ready to take action? Here’s 3 ways I can help you:

1. Consulting Offer Blueprint - Validate your consulting offer in 48 hours.

2. Part-Time Consulting Launchpad - Join over 100 professionals who have launched their consulting businesses in our 8-week cohort program.

3. Portfolio Path Membership - Our invite-only community of portfolio careerists experimenting, learning, and growing together.