Today, in 10 minutes or less, you'll learn:

FROM OUR PARTNERS

Generate more repeat purchases with Black Crow AI

Black Crow AI helps merchants recognize 100% of returning users and predicts shopping behavior patterns so you can effortlessly acquire more sales.

Their Shopify app plugs into your tech stack with zero development work required. And everything is set up for you to see clear incremental revenue so you can judge the value for yourself during a 30-day free trial.

Their team is so confident you’ll see 5-8X ROI that they’re offering a $100 Amazon gift card to Shopify brands with $2M+ in annual revenue just to get a demo.

📊 How I’d invest $100k today

Recently, I was asked if I were given $100k today, how would I invest it?

I reflected a bit on this question.

Assuming:

This is my first $100k of savings

I’m in the middle on risk tolerance spectrum (not too high, not too low)

My goal is to save for semi-retirement (not FIRE) in my early 40’s, while enjoying my life now

No kids or major health expenses

How Above-Average Households Invest

First, I’d look at other households - what benchmarks can I use to guide my decision-making?

Let’s start with average households. The US Federal Reserve provides a rare glimpse into asset allocation by household net worth tier.

Let’s take a look at the $100k tier:

It’s mainly primary residence

With a small chunk of retirement assets (eg stocks/bonds)

Now let’s consider above-average households.

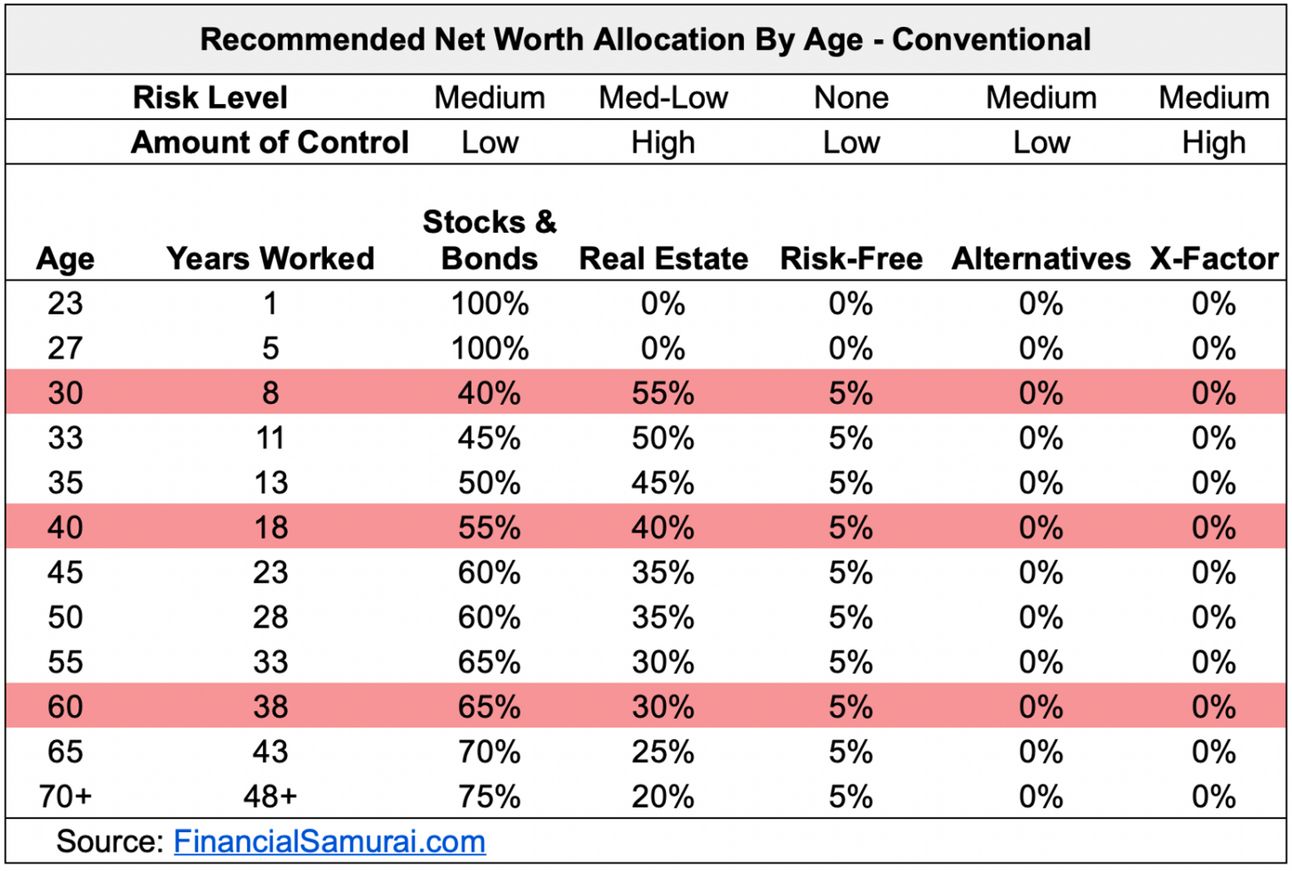

Here’s a conventional net worth allocation recommended by Financial Samurai for people who are willing to work until the traditional retirement age of 65+:

Mainly stocks and bonds

With a healthy chunk of real estate

These are a couple examples of benchmarks I would consider.

I would dig into the “why” behind these allocations and see if they align to my goals.

My Portfolio Approach

Here’s how I would allocate $100k:

Cash/Risk-free: 25%

Stocks: 45%

Real Estate: 20%

Business/Fun Money: 10%

Cash/Risk-Free ($25k)

I’d allocate enough for a 6-month emergency fund.

In this case, I’m assuming I’m living in a tier 2 global city like Mexico City, Austin, or Melbourne.

$4k/month would cover my day-to-day individual living expenses (again, no kids).

If I were living in a tier 1 city like San Francisco, Singapore, or Sydney, I’d increase this a bit.

I’d put 2/3 of this amount into a short-duration like 4-week US Treasury Bills using TreasuryDirect.gov

Here’s why:

~5.3% interest rate

4 week duration

Automatic reinvestment

Free (no fees)

Note: This will not be very liquid during the bond duration, so make sure you don’t need the capital within 28 days.

Then I’d put the other 1/3 into my high-yield savings account. This is just in case I need liquid funds for a seriously emergency situation.

For years, I’ve used a Capital One High-Yield Savings Account:

100% liquid

4.3% interest rate

No fees

$250k FDIC coverage

Betterment Cash and other interesting cash options have also emerged on the market. I’ll do some research and come back with any changes I’d make (if any).

Over the next 3-6 months, I’d invest the remaining cash in the following:

Public Stock Index Funds ($45k)

I’ll go in order of risk.

Public equities have shown a ~7% return (after inflation) over the past 200 years, making it one of the best-performing asset classes:

Stocks for the Long Run by Jeremy Siegel

I view public equities as a foundational component of my portfolio.

Furthermore, I view this as a long-term investment for retirement goals. I don’t expect to withdraw the capital I allocate to equities for another 10+ years.

I prefer low-fee passively managed index funds that track a broad, diverse market index.

Picking individual stocks is a very difficult game. 90% of the S&P 500 companies since 1955 have gone bankrupt, been acquired or fell off the list.

As an American, my favorite index funds are:

VTI - Total US Stock Market Index

VXUS - Total International Stock Market Index

If I were non-American:

I would consider non-US ETFs to avoid US dividend and estate taxes.

For example, All World UCITS ETF (VWRA) and S&P 500 UCITS ETF (VUAG).

Real Estate ($20k)

I like Real Estate as a part of my portfolio due to:

Consistent long-term growth

Passive income generation

Inflation hedge

Over the past 50 years, US REITs have generated relatively higher returns (12.7%) than the S&P 500 (10.2%).

With that said, past performance doesn’t guarantee future returns. You can see in recent years, stocks have largely outperformed REITs:

However, real estate also consistently generates passive income.

With $20k invested, the distributions won’t be much — but you’ll get a taste for if this is a compelling proposition to you.

You can either go with Real Estate Funds or individual REITs.

For funds, I prefer low-fee, diversified real estate fund like Vanguard Real Estate Fund (VNQ).

I’ve also used Fundrise for private US real estate funds (see their returns vs public REITs vs S&P 500) So far, my Fundrise portfolio performance has been comparable to my public US REITs, but will see in the long-run.

For individual REITs, I still hold some REITs with a long track record like:

O - Reality Income

OHI - Omega Healthcare Investors

Business/Fun Money (10%)

I’d allocate 10% to entrepreneurship and “moonshot” opportunities.

For example:

Seed capital for your own business

Angel investment into a friend’s startup

Down payment to buy a SMB (though this would require more)

While not everyone is designed to be an entrepreneur, I think it’s smart to give yourself some leeway to experiment in high-risk pursuits.

This is a bit of a “dumbbell” strategy.

While the bulk of your portfolio is lower in risk profile, the other end of your dumbbell gives you the chance to capture very high-reward opportunities.

But also be cautious with your investing here and take it slow.

I’d expect to lose 100% of this money.

And don’t rule out the notion of taking a bet on yourself with it.

Summary

So that’s it.

This is how I’d allocate $100k:

Cash/Risk-free: 25%

Stocks: 45%

Real Estate: 20%

Business/Fun Money: 10%

Hit reply and let me know if you agree with this allocation.

(and what you’d do differently).

🌐 Beyond your borders

🇲🇾 Malaysia to offer incentives to attract global tech companies (link)

☕ Couple grew their basement side hustle into a business bringing in $4.5M/year: We’d ‘never seen anything like that in a bank account’ (link)

🤑 r/side hustle What's Your Most Unexpectedly Profitable Side Hustle? (link)

🏠 How do you actually ‘use’ your home equity? (link)

🧰 Tool of the week

Mercury Business Bank Account

Mercury powers Money Abroad's main business bank account.

We love using it for our checking and savings accounts, automated transfers (to setup Profit First), physical and virtual debit cards, domestic and international wires, and integrations.

Plus, no monthly fees.

*this is a sponsored link

📆 How I can help

That’s all for today!

Whenever you’re ready, here’s how I can help you:

1. Join my Side Hustle Crash Course (free) - Click here to receive my free, 5-day email course teaching you how to build a profitable side hustle.

2. Join my Remote Side Hustle 4-Week Program - Save your seat for my next cohort in Fall 2024.

3. Work with my tax team - Get personalized guidance from a US expat tax professional.

4. Sponsor this newsletter - Get in front of over 6,000 professionals and business owners in the US and Singapore.