I’m often asked, “how do wealthy people allocate their assets?”

Today, in 10 minutes or less, you’ll learn:

👨👩👦 How US Households Allocate Their Net Worth by Wealth Tier

✅ Asset Allocation Benchmarks for Financial Independence Seekers

📊 Patterns and Trends across 5 asset classes: Primary Residence, Retirement Funds, Stocks, Real Estate, and Business Interests

FROM OUR PARTNERS

🗺 Manage your accounts in 12 countries effortlessly

As expats, my wife and I have financial accounts across 3 countries:

United States 🇺🇸 , Singapore 🇸🇬 , and Australia 🇦🇺

It’s been a logistical nightmare to manage our finances across these accounts, currencies, and geographies.

Meet Strabo.

With a few clicks, I can access all my international accounts, filter my portfolio tracker by currencies, and see my assets and liabilities broken down by currency denomination.

Strabo can:

Show me a multi-currency view of my portfolio on my Dashboard 💶

Sync all accounts into one sleek portfolio tracker 📊

Add custom tags for easy organization and tracking progress 🏷

Forecast for retirement and towards my financial goals 🎯

Finally take control of your finances. Sign up for free today — for a limited time only!

🤑 How high net worth households allocate their wealth

After synthesizing data from Tiger21, Hampton, and the US Federal Reserve, I’ve learned a few key lessons about asset allocation.

In particular, the US Federal Reserve provides a rare glimpse into asset allocation by household net worth tier.

From $10k all the way up to $1B.

Here’s the skinny:

Expect your net worth composition to change significantly as wealth grows.

Here’s 6 of my key takeaways:

$1M-$10M net worth is a useful benchmark for financial independence seekers.

Primary Residence as % of assets decreases as wealth accumulates.

Retirement Funds as % of assets peaks at $100k-$1M net worth, then declines.

Stocks as % of assets grows as wealth accumulates.

Real Estate as % of assets peaks in between $1M-$10M net worth then declines.

Business Interests as % of assets grows as wealth accumulates.

1/ $1M-$10M net worth is a useful benchmark for financial independence seekers

Many Money Abroad readers are chasing financial independence.

Given that most people I know have a FIRE number within the $1M-$10M net worth range, this tier is a helpful reference point for myself (and these readers).

Asset Allocation of Wealthy Households ($1M-$10M)

Liquid: 5%-10%

Primary Residence: 10%-25%

Retirement Funds: 10%-25%

Stocks and Mutual Funds: 10%-30%

Real Estate: ~10%

Business Interests: 20%-40%

What surprises me:

Relatively small % allocated towards stocks and non-primary residence real estate

Business interests make up a huge chunk — and an even bigger one for the ultra-wealthy ($10M+)

2/ Primary Residence as % of assets decreases as wealth accumulates

For many households, buying a home is the ultimate dream.

Despite not having much, my parents prioritized home purchase as one of their top financial goals.

The Fed data shows that while primary residence makes up over 30% of net worth for households with $10k to $100k, this drops to single digits for households with over $10M.

Hampton’s dataset of high-net-worth entrepreneurs shows a similar pattern. Primary residence allocation % drops as net worth grows.

My suggestion:

Shoot for primary residence to make up no more than 30% of your net worth. It’s generally illiquid, which reduces flexibility.

And if 2008 taught us anything, it’s that tying up a large part of your wealth in one property can lead to heaps of risk in a bad market.

3/ Retirement Funds as % of assets peaks at $100k-$1M net worth, then declines

Retirement funds include pensions and tax advantaged accounts (e.g. IRAs in the US).

These typically have a maximum annual contribution limit.

While retirement funds are excellent for accumulating wealth due to tax advantages, they’re challenging to maintain as a % of assets beyond a few million in net worth.

Hence, the ultra-wealthy don’t have a relatively large holding in their retirement accounts.

My suggestion:

Maximize tax-advantaged retirement accounts.

Find new contribution opportunities (e.g. most people in the US still don’t know about business retirement accounts like Solo401k’s).

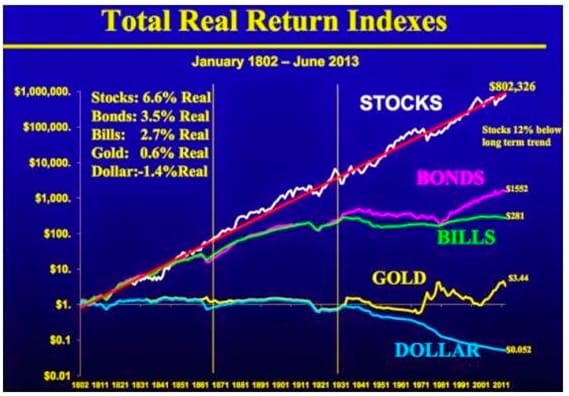

4/ Stocks as % of assets grows as wealth accumulates

Stocks and Mutual Funds starts off as <5% of assets for households in the $100K tier or below.

Then it balloons to over 20% for households in the $10M tier and above.

Why?

I can only speculate that these households have saturated their retirement funds, so they shift more allocation towards stocks and mutual funds.

Why not bonds or other assets?

Well, equities have been one of the best-performing asset class within the past 200 years (if not the best).

My suggestion:

For the above-average person, buy low-fee passively managed ETFs or index funds that track a broad market index. Automate your investing.

Picking individual stocks is a very difficult game. 90% of the S&P 500 companies since 1955 have gone bankrupt, been acquired or fell off the list.

For example, here’s a few index funds I buy:

VOO - S&P 500 index

VTI - Total Stock Market Index

VXUS - Total International Stock Market Index

5/ Real Estate as % of assets peaks in between $1M-$10M net worth then declines

Real Estate starts in the small single digits for households in the <$100k tier, grows to 10% of assets for $1M-$10M net worth, and then shrinks back down to single digits again above $10M.

Real estate is a popular vehicle for generating regular cashflow.

But why don’t the ultra-wealthy hold a higher real estate allocation?

According to the Fed data, two other asset classes take priority for this class:

Stocks and Business Interests

Here’s a few thoughts on why:

Stocks are relatively more scalable than real estate. You can passively grow your stock holdings, while real estate requires a bit more active overhead.

Owned businesses have more flexibility in how you want to build and grow your business. Depending on your products and industry, you may also have more growth opportunities than real estate.

My suggestion:

Run the numbers carefully when researching property. Take into account hidden costs and expenses (including your time).

6/ Business Interests as % of assets grows as wealth accumulates

Owning businesses is a critical part of wealthy and ultra-wealthy portfolios.

While Business Interests make up 20-40% of assets for wealth households, it balloons to over 50% for ultra-wealthy households.

Hampton’s data is skewed towards entrepreneurs, but also shows 40% to 70% of assets across wealth levels tends to be held in business interests.

Tiger21 shows 31% of their entrepreneur assets are also held in private company holdings.

My suggestion:

Find opportunities to gain business equity. Work for equity-based compensation, invest in businesses, or start a business.

🌐 Beyond your borders

🧾 Many business owners struggle with profitability - use Profit First to ensure you get paid first. I recently setup the Profit First accounting method with my Mercury bank accounts. It’s been game-changing (link)

🚀 How to sell your Big Tech RSUs from ex-Facebook FIRE strategist. Andre shares how he and his partner personally sell their Facebook and Uber RSUs, navigate tax impact, and busts RSU myths out in the wild (link)

🍎 Insider emails of Google’s negotiation with Apple. As a tech worker, it’s important to understand the inner workings of the tech industry. Reading actual emails that get leaked in court cases is one of my favorite methods (link)

📆 How I can help

That’s all for today!

Whenever you’re ready, here’s how I can help you:

1. Join the Remote Side Hustle program - Get first dips when the next cohort opens up in Spring 2024 (last cohort sold out).

2. Work with my tax team - Get personalized guidance from a US expat tax professional.

3. Sponsor this newsletter - Get in front of over 5,000 professionals and business owners in the US and Singapore.