Our Singapore meetup was so fun! 🥳

If you’ve thought about building a new income stream in 2025, then we’re offering a Black Friday special for our cohort on November 26-29. RSVP for the waitlist now.

Today, in 10 minutes or less, you’ll learn:

🌏 How to create a hands-off international money system that works while you sleep

🧰 The exact tools high-performers use to automate their wealth-building

🏦 How to implement the Profit First method for your business finances

📆 Two proven monthly timelines to schedule all your money moves

FROM OUR PARTNERS

Announcing… the 5-Day Monetize Your Expertise Mini-Course! 🤩

Exciting news! I revamped my ENTIRE mini-course with fresh video lessons. 💥

Over 5 days, you’ll learn how I earned 6-figures through consulting side hustles taking 10 hours/week, kickstarting my portfolio career.

I'll teach you step-by-step how to choose your niche, test, and launch your consulting side hustle.

Want to learn more? Don’t miss my new videos.

Enroll in my free 5-Day Monetize Your Expertise Mini-Course:

P.S. I’m launching a Black Friday Special on November 26th. Limited Time Offer (50% Off) for our Next Cohort Starting January 7th, 2025. RSVP for the Waitlist Now.

⚙ 5 Ways to Automate Your Finances

"I just missed another investment." 🤦

That was me, staring at my phone in Singapore at 11 PM, realizing I'd forgotten—again—to transfer money to my US brokerage account.

I was dropping the ball on basic money moves.

Sound familiar?

Multiple accounts across countries

A growing investment portfolio

Family finances to juggle

A business to run

And the constant fear of missing something important

After one too many late-night panic sessions, I built a system to manage most of my money automatically.

No more forgotten transfers.

No more missed investment opportunities.

No more late-night money stress.

In this newsletter, I'll breakdown the exact 5-part automation system I have used to manage:

International transfers

Investment contributions

Bill payments

Family finances

Business accounts

But first, let me explain why high-performers need to stop managing money manually...

🤔 Why “Set and Forget”?

Growing up, “I’ll do it myself” was my mantra.

Like many high achievers, I prided myself on taking control.

But here's what I learned the hard way:

Manual money operations are not worth your time.

Now? I delegate and automate as much as I can.

Here’s why:

Reduces my decision fatigue

Avoids relying on self-control to invest

Saves myself from making costly mistakes

Converts my overwhelm into peace of mind

This is how I do it:

🌏 International Money Transfer

When I lived in Singapore, I got swamped with work.

And I completely forgot to transfer money to my US accounts.

My credit card payment bounced. I missed my scheduled investment. And I got hit with fees.

Yikes.

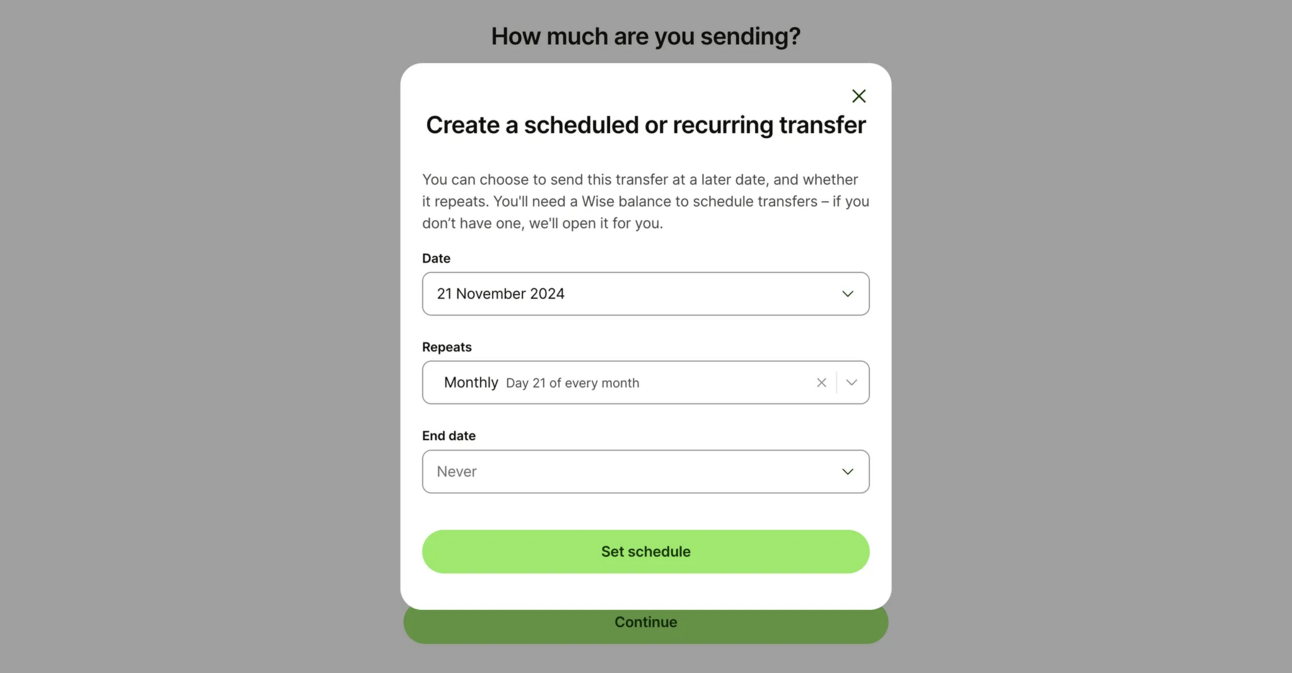

The Tool: Wise (sign up)

Fortunately, I discovered Wise allows you to schedule recurring cross-border transfers.

My exact setup:

Monthly transfer from Singapore → US accounts

Automated payments to US credit cards and investments

How to implement:

Link your accounts to Wise

Setup forward transfers (Wise → foreign accounts)

Pro Tip: Schedule international transfers 3 days before you need the money in your destination account. This builds in a buffer for processing times.

📊 Investments & Savings

"I'll invest when the market dips further."

That was me in 2020. I had cash ready but kept waiting for the "perfect" moment.

Result? I missed a portion of the bull market.

In retrospect, I should have just automated my investment schedule.

Now, my monthly investing and savings run like clockwork:

6-Month Emergency Fund

Kid’s 529 College Savings

Taxable/Retirement Investments

How to implement:

Schedule monthly transfers:

From your payroll to your pre-tax retirement accounts

From your checking to your post-tax investment accounts (Taxable, Retirement)

From your checking to your savings accounts (Emergency Fund, Savings Goals)

💳 Bill Payments

Missed your credit card payment? Been there.

Now, I schedule all my monthly payments for my credit cards:

AMEX Platinum (personal)

AMEX Bonvoy (personal)

Mercury IO (business)

AMEX Blue Business Plus (business)

How to implement:

List every recurring payments (Credit Cards, Utilities, Loans, Etc.)

Link your checking account to the bill payments

Setup a monthly autopay

Pro-Tip: Set bill payment dates 5 days after your salary deposit, to ensure you always have enough in your checking account

👨👩👧👦 Family Finance

How do you split the bills? Which accounts should you combine?

These questions hit me hard after getting married.

After trying several approaches, here's what worked:

Yours, Mine, Ours System:

Joint checking for all fixed costs (rent, utilities, groceries/food)

Joint savings for couple savings goals (honeymoon, business)

Separate accounts for personal investments and worry-free spending

The Tool: Mercury Personal (sign up)

Mercury Personal ($240/year) has been a savior.

Why it works:

No SSN required to add non-US spouse (as user)

Multiple linked accounts

Automated transfers between accounts

Individual debit cards for joint accounts

How to implement:

Decide to combine all, some, or none of your accounts

Create distinct joint accounts for various purposes

Calculate how much to contribute to your joint accounts

Schedule recurring transfers to your joint accounts

Here is how we determined the amount to transfer:

Calculate total household income ($300k example)

Determine income split (60/40 let’s say)

Apply same ratio to expenses ($6k/$4k monthly)

Automate transfers on a monthly basis

🧑💻 Business Finance

Where did all the money go?

That was me a few years ago, staring at my business account, wondering why I still had no profit despite healthy revenue.

The problem? I was paying expenses first, treating profit as an afterthought.

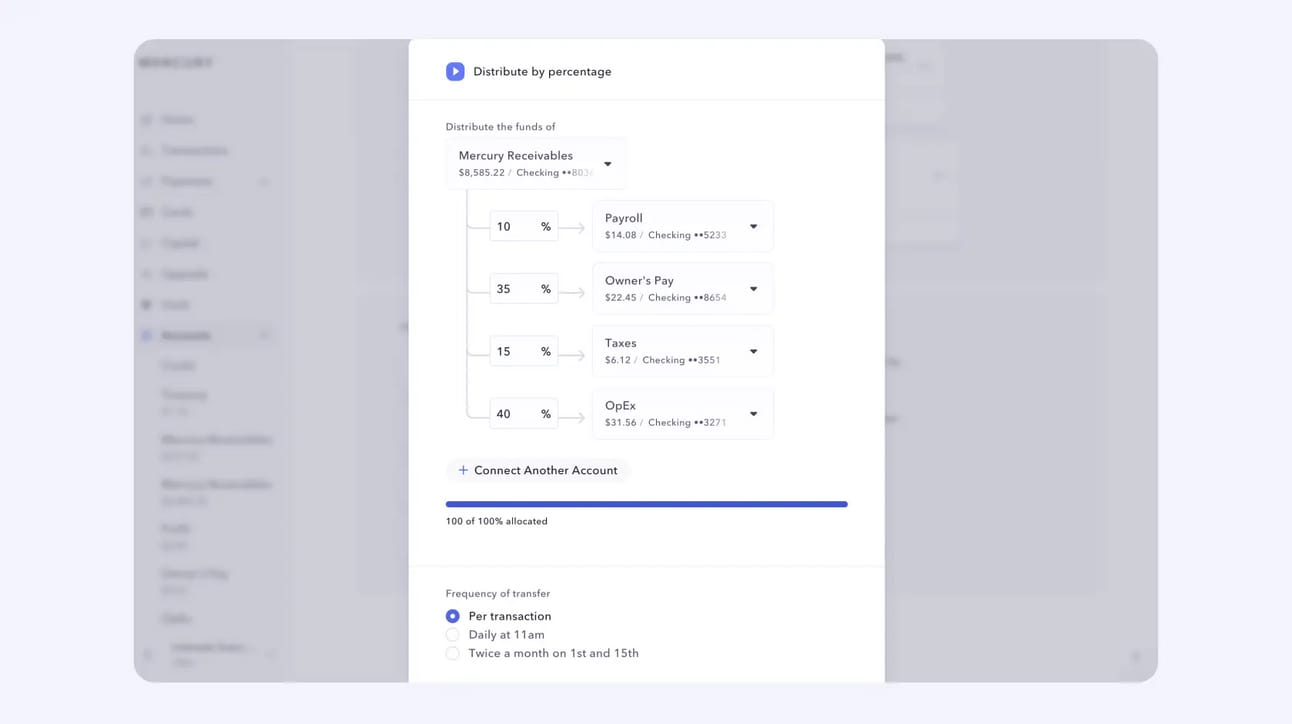

Now, I use Mercury Business Banking automations to avoid this pain:

The Tool: Mercury Business (sign up)

I use Mercury Business to setup multiple business bank accounts and auto transfer rules between the accounts.

You can use these capabilities to setup Profit First rules.

How to implement:

I setup 5 bank accounts:

Income (revenue starts here)

Profit (5% of income)

Owner’s Pay (50%)

Expenses (30%)

Taxes (15%)

Daily Automation Rules:

Revenue comes into Income account

Mercury automatically distributes based on percentages

Transfers happen daily (not monthly) for better cash flow

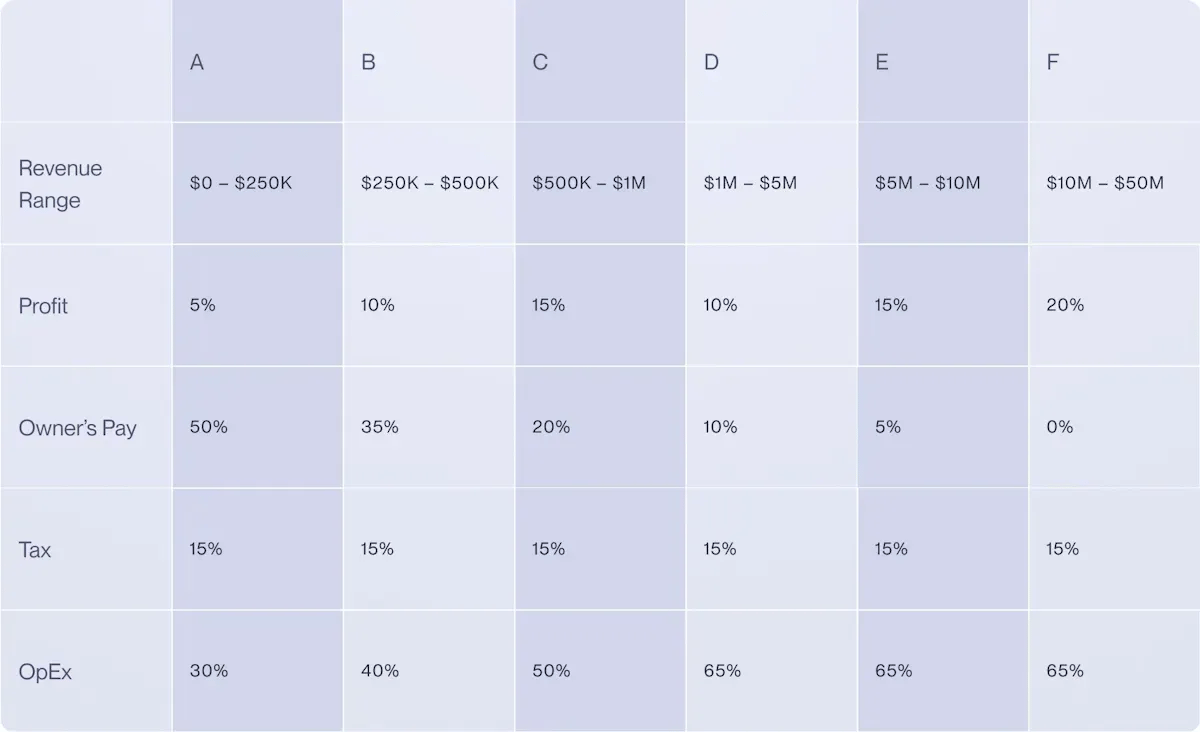

Pro-Tip: Here are rough Profit First guidelines on Profit, Owner’s Pay, Tax, and OpEx splits:

📆 Monthly Schedules

Here are two monthly schedules heavily inspired by my own workflows:

Example 1: Full-Time Professional, Singapore-Based, US Expat

This monthly schedule combines the international money transfer, savings and investment, bill payments, and family finance use cases.

Date | Transaction | Start Account | End Account |

|---|---|---|---|

25th | Salary Deposit | Employer | SG Checking |

27th | Transfer to Joint Checking | SG Checking | SG Joint Checking |

28th | Transfer to Wise | SG Checking | Wise |

29th | X-Border Transfer to US Checking | Wise | US Checking |

5th | Credit Card Payment | US Checking | Credit Card |

7th | Investment Contribution | US Checking | Brokerage |

Example 2: US LLC/S-Corp Business Owner, Married

This monthly schedule combines the savings and investment, bill payments, family finance, and small business use cases.

Date | Transaction | Start Account | End Account |

|---|---|---|---|

1st | Salary Deposit | Gusto/Payroll | Primary Checking |

2nd | Emergency Fund Transfer | Primary Checking | Savings Account |

3rd | Investment Transfer | Primary Checking | Brokerage Account |

3rd | 529 College Savings | Primary Checking | 529 Account |

4th | Credit Card(s) Payment | Primary Checking | AMEX |

5th | Joint Account Transfer | Personal Checking | Mercury Joint Account |

25th | Rent Payment | Joint Account | Property Manager |

Daily | Business Profit Distribution | Mercury Business Income | Profit Account |

Daily | Business Tax Reserve | Mercury Business Income | Tax Account |

Daily | Business Operating Expenses | Mercury Business Income | OpEx Account |

Daily | Business Owner’s Pay | Mercury Business Income | Owner’s Pay |

In Summary

The true cost of “doing it yourself”:

Mental bandwidth drain

Missed opportunities

Relationship stress

Lost time

My 5-part automated money system:

International: Wise for cross-border transfers

Investments: Automated contributions

Bills: Scheduled payments

Family: Mercury Personal for joint finances

Business: Mercury Business with Profit First

Action steps for this week:

Map your current money flows

Choose ONE system to automate first

Set up your first automated transfer

Mark your calendar to review it in 30 days

Rinse and repeat!

🌐 Beyond your borders

✅ Ideal Order Of Investing For High Income Earners (Youtube)

🥱 The Cost of Apathy. (JR)

⌛ Struggling with appreciating time and being stingy with expenses is stunting growth (Reddit)

Yesterday, we hosted an intimate meetup for Money Abroad readers, cohort students, and community friends in Singapore. 🇸🇬

FROM OUR READERS

What do you think of this edition? Reply or rate it at the bottom of this email.

📆 How I can help

That’s all for today!

Whenever you’re ready, here’s 4 ways I can help you:

1. Monetize Your Expertise Mini-Course (free) - Receive my free, 5-day course teaching you the foundations of monetizing your expertise outside of your day job.

2. Part-Time Consulting Launchpad - Click to join the waitlist for my January 2025 cohort. This teaches the system I used to earn 6-figures from my consulting side hustles taking 10 hours/week. [Black Friday Special - 50% Off]

3. Tools I use and recommend - Uncover my favorite tools for personal finance and business.

4. Promote yourself to 6,000+ high-performers by sponsoring my newsletter.

🧠 Social snippets